Spanish Electricity Market and Rates

Including, what is Maximum Contracted Power?

Note that some of the links are to content in Spanish or Catalan.

Added: Maximum Contracted Power is called Demand Charges in the US.

Basic Structure of an Electrical Grid

Different jurisdictions organize the components of an electrical grid in different ways.

Spain’s electrical infrastructure separates Transmission, Generation, Distribution and Retailing. Customers have the right to connect to the electrical grid. There is a single Transmission company for the whole country. The other 3 pieces can be provided by separate companies or by a single company. Three companies (Iberdrola, Endesa and Naturgy) own over 90% of this market but there are many smaller companies involved in one or more of the infrastructure pieces.

Note: If you are interested in some compare and contrast, check out these two articles: Comparing CCAs to IOUs and POU and Two-Way Tariff in Australia.

In some more detail,

Transmission

Red Electrica de España (Redeia / REE) owns and operates (TSO) the high voltage lines, over 220kV, in Spain. The company was created in 1985 and it was the first enterprise in the world focused only in transmission. REE follows the European directives 2003/54 (Spanish Ruling) and is regulated by the state. REE ownership is 20% by the state and the rest by different entities. REE owns more than 24,800 miles of high voltage lines (as a way of comparison, PG&E owns over 18,500 miles).

Transmission cost is ultimately paid by the customers. They pay the retailers, who pay distributors who pay REE for the right to use the lines. I assume so do the generators, and customers also pay for generated electricity. I do not know whether there are additional subsidies from the Spanish Government or the European Union.

Generation

Generation in Spain is deregulated. There are many players, some very big, some very small (e.g. small hydro, small solar plant, small wind turbine).

Distribution

Distribution covers electrical lines under 220kV. They are regulated and are a monopoly by region. For instance, edistribucion - part of Endesa and shown in blue below - owns distribution in Catalonia. Smart meters are ubiquitous.

Retailing (aka “Comercializadoras”)

Retailing is deregulated. There are more than 500 companies in Spain (see official listing). The Big 3 are Iberdrola, Endesa, Naturgy Naturgy

Here are some examples of Smaller Players:

HolaLuz (wikipedia) was an early adopter of rooftop solar. They also have introduced new solutions like using excess generation in one property to pay for consumption in another and virtual batteries.

ElectraCentelles is an example of a very local company. They are a generator, distribution and retailer serving the city of Centelles.

Spain had a wave of electrical Coops in the late 19th, and early 20th century (earlier than in the USA) but most of them disappeared after the Spanish Civil War. After 2010 there has been a small resurgence, focused on renewable energy. Some examples:

Som Energia (wikipedia). Below I show some of their TOU and RTP Tariffs.

Ekioloa (also see here) and GoiEner are coops in the Basque country.

There are also Regulated Retailers like Naturgy Regulada.

Interacting With A Spanish Retailer

A customer has a contract with a retailer. The retailer buys electricity from the generators and uses a distributor to reach the customer. The terms and conditions of the customer contract can vary. As of 2018, all electricity meters with a contracted power of up to 15kW must be smart meters capable of time-based pricing and remote management; these meters are owned by the distributors. The retailer can pay for distributed energy exported by the customer.

Cost of Electricity

The cost of an electrical bill includes the cost of max contracted power, plus the cost of delivering the energy, plus a few odds and ends. The rates for the costs can be based on periods (a time-of-use rate) or on using a formula leveraging the real time cost of electricity.

CUP

A CUPS (Codigo Unificado de Punto de Suministro) uniquely identifies every connection to the grid.

CIE

The CIE (Certificado de Instalacion Electrica) is part of the rules for low voltage (REBT). A CIE is needed to connect a CUP to the grid. It is also needed to change the contracted power. A CIE is issued by a certified inspector, not by the city, or the utility.

A CIE includes details like the type of installation, maximum allowed power, voltage and line diagram. Depending on the situation, it may require regular reinspections.

Contracted Power

The maximum contracted power charge is used to cover the cost of delivering the energy, including connecting to the transmission grid, transformers, distribution lines, congestion, and what-have-you. A customer will pay more if their CUP is contracted for a larger power. The section example below shows some rates for a retailer and it also shows that “small” connections (under 15kW) have different rates than “large” connections (over 15kW).

The cost of contracting power may be computed as “per-day” or “per year”. Also, the contracted power can vary depending on the period, so the most economical way to connect is to request just the power needed at a given time. The contracted power has to be allowed by the installation, and it is proved through a CIE (see above).

“Old” installations would have a main power control controlling maximum power. Nowadays the control is done through the customer’s smart meter. If an installation goes over the contracted power the customer may incur economic costs and, depending on the setup, its power may be interrupted.

Changing Contracted Power

The power contracted can be changed online, assuming the installation allows the new values. A change requires providing a valid CIE.

Value of Energy under Real-Time Tariffs

The value of energy for RTP is based on the energy value from OMIE, which manages the intra-day and day ahead energy market for the Iberian Peninsula (Spain and Portugal).

Renewable Energy

The origin of renewables energy is tracked through a GDO certificate; see Som Energia or official doc.

An example of a Tariff

Here are some Som Energia rates.

Time-of-Use rates come in two variants.

The 2.0TD rate is for “low voltage, up to 15kW”.

The 3.0TD rate is for “low voltage, above 15kW”.

Indexed rates (Real Time Rates) follow a formula based on the real time energy cost.

There are also tariffs for EV chargers for public access.

Here is a screenshot of TOU rate for 2.0TD, low voltage, up to 15kW, taxes included

Translated,

Contracted Power

Peak/Part Peak: 36.900 €/kW year

Off Peak: 3.5459 €/kW year

Energy

Peak: 0.3065 €/kWh

Partial Peak: 0.2111 €/kWh

Off Peak: 0.1615 €/kWh

Exported

All periods: 0.063593 €/kWh

Our California house has solar panels and we regularly export energy. Using the above numbers we see that 0.063€ is 20% of 0.306€ (and 28% of 0.161€) which is a much higher percentage than the export rate of the “new” NBT (but less than the “old” NEM 2.0).

Parting Thoughts

Some parting thoughts, from the perspective of a California ratepayer. In Spain, I can choose my retailer or my coop. My rates can be TOU or RTP. My excess self-generated electricity will be compensated based on what my retailer wants to give me. There are some very large electrical vendors but also tiny ones. Companies are incentivized to compete with each other, in rates and features like virtual batteries.

As I go through this I think, not for the first time, that we, California, still have ways to go before having a modern electrical system.

Addendum: Electricity Prices in Europe

I bumped into a report from the European Union on Electricity prices. Below are two images; check the report for details.

The first image is a map of Europe and it shows that electricity in Spain is relatively “cheap”. The map uses PPS. PPS is an artificial currency unit; theoretically, one PPS can buy the same amount of goods and services in each country. Here is the US/Spain comparison from OECD.

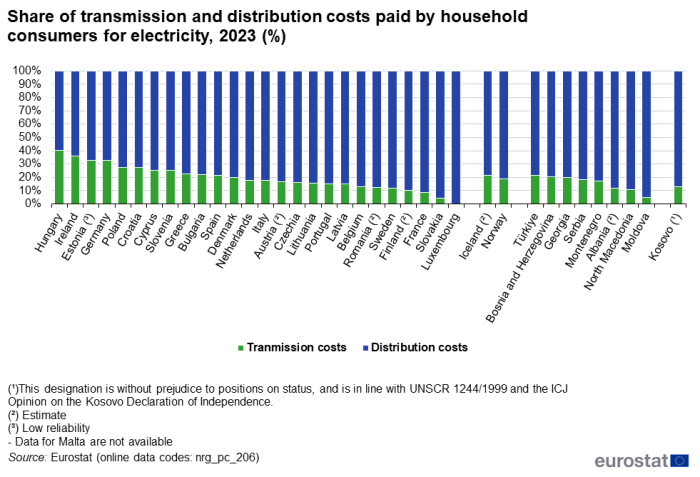

The second image is a chart showing the share of transmission and distribution costs in Europe. I don’t know what is the number in the PG&E territory; PG&E bundles both under “delivery”.